Data from the Institute of Supply Management (ISM) indicate improving economic conditions are benefiting U.S. manufacturers. By July 2017, the ISM Purchasing Managers Index (PMI) rose to 57.8%.1 This was up from 54.9% in June and the highest since mid-2014. The numbers are significant because they provide a measure of how likely manufacturers are to buy products such as metalworking machinery, equipment, and software.

Significance of the Current Findings

There are 18 industries tracked by ISM. Of those, 15 reported growth in June. The readings are significant because those over 50% show that business and the manufacturing sector are expanding. Numbers below that benchmark indicate contraction.

Nonetheless, the pace has not slowed down. The PMI stood at 58.7% in October 2017,2 higher than June but slightly lower than September’s 60.8 reading. The ISM reported continued growth in new orders, production, employment, and order backlogs. In the October manufacturing report, the institute’s feedback from a panel indicates expanding business conditions, including growth in production, new orders, and export orders.

A slowing of supplier deliveries indicates an improvement, as does a contraction of inventories. In October, 16 manufacturing industries reported growth, including:

- Paper Products

- Nonmetallic Mineral Products

- Machinery

- Transportation Equipment

- Wood Products

- Food, Beverage & Tobacco Products

- Miscellaneous Manufacturing

- Petroleum & Coal Products

- Plastics & Rubber Products

- Textile Mills

- Chemical Products

- Computer & Electronic Products

- Fabricated Metal Products

- Furniture & Related Products

- Electrical Equipment

- Appliances & Components

- Primary Metals

Importance of the ISM Index

The index is essentially a survey of purchasing and supply executives. They are surveyed because the rate at which they order raw materials and supplies from manufacturing companies tends to reflect broader economic conditions. For example, the purchase of metal-bending equipment may rise as the economy improves and fall if there may be an impending recession.

Reports are issued monthly, providing a look at the most current business activity.

Markit Reports a Similar Trend

In June, Markit, a financial data firm, reported an increase to 57.3 of its U.S. Manufacturing Purchase Managers Index. Like the ISM index, a reading above 50 indicates economic expansion. The index, output subindex, and read on new orders were all at their highest levels since April 2010, meaning that business for U.S. goods producers was growing a faster rate than it has in a while.3

Factory output, order books, employment, and payroll numbers were rising fast as well, in some cases the most since the recession, according to Markit’s Chief Economist Chris Williamson.

What It Means for Business

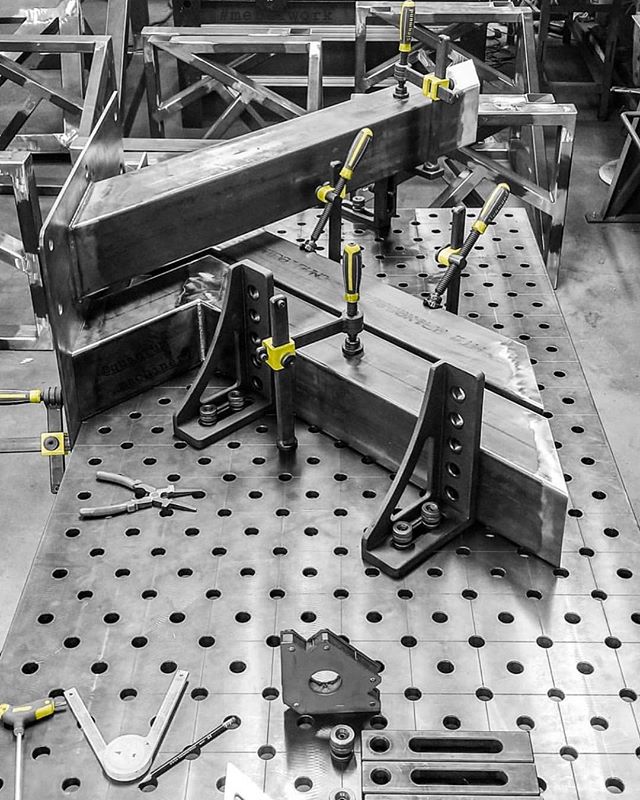

For machinery providers and software companies/SaaS service providers, the latest economic improvement means an increase in business opportunities. Companies are investing in software and metalworking, cutting, bending, welding, and other machines.

If the demand for products is increasing your need for high-quality, versatile equipment, contact Quantum Machinery Group online, email sales@quantummachinery.com, or call our service department at 909-476-8007.

Sources

- https://www.marketwatch.com/story/us-manufacturers-growing-at-fastest-pace-in-three-years-ism-finds-2017-07-03

- https://www.instituteforsupplymanagement.org/ismreport/mfgrob.cfm?SSO=1

- http://www.reuters.com/article/us-usa-economy-markit-manufacturing/u-s-manufacturing-expands-in-june-at-fastest-rate-in-over-four-years-markit-idUSKBN0F64DO20140701