Great news for machinery buyers: Section 179 of the U.S. Internal Revenue Code has been restored to $500,000 for 2017.

In a nutshell:

- Businesses can deduct up to $500,000 from their taxes on up to $2 million in qualifying equipment purchases.

- All purchases, financing, delivery and set-up must be complete before midnight on 12/31/2017 for both equipment and software.

- A bonus depreciation is in place for all businesses who have purchased over $2 million in equipment. They can depreciate 50% of the cost of the equipment they purchase and put into production from 2015 through 2017. (This bonus depreciation reduces to 40% in 2018 and to 30% in 2019.)

This is great news if you’ve been thinking about purchasing new machine tools for your business. But this deduction only applies to machines ordered and delivered by December 31st, so you must act quickly to take advantage of these savings.

The following examples help explain how all this works:

Example of Section 179 Deduction

In this first example, you can see a detailed overview of your savings if you take advantage of the Section 179 tax break. If you purchase $250,000 in equipment, you can earn $87,500 in savings, decreasing the total amount you spend to $162,500.

- Cost of Equipment: $250,000.00

- Section 179 Deduction: $250,000.00

- Total First Year Deduction: $250,000.00

- Cost of Savings on Equipment Purchase: $87,500.00

- Lowered Cost of Equipment After Tax Savings: $162,500.00

Example of Bonus Depreciation

In this second example, you are shown a detailed overview of the bonus savings should you spend over $2 million on equipment and be eligible for bonus depreciation.

- Cost of Equipment: $2,500,000.00

- Section 179 Deduction: $500,000.00

- 50% Bonus Depreciation Deduction: $1,000,000.00

- Regular First Year Depreciation: $200,000.00

- Total First Year Deduction: $1,700,000.00

- Cost of Savings on Equipment Purchase: $595,000.00

- Lowered Cost of Equipment After Tax Savings: $1,905,000.00

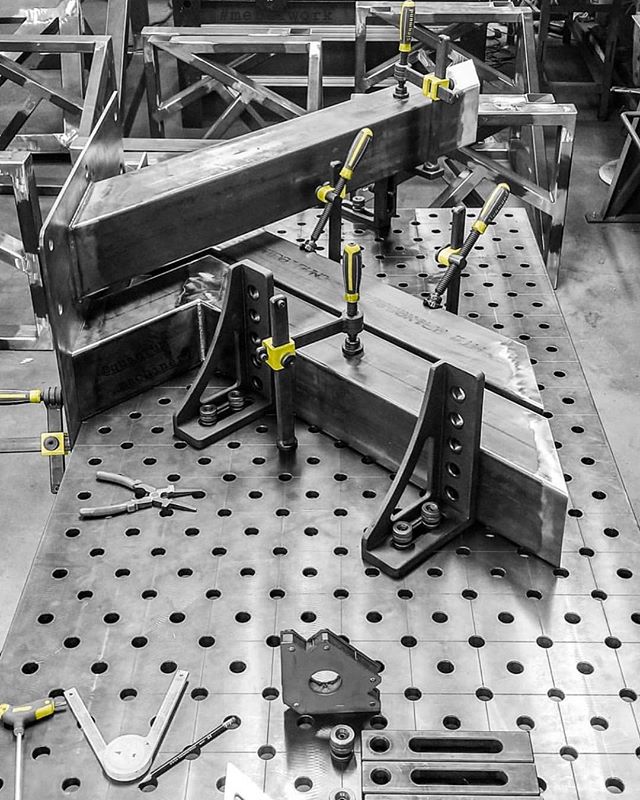

Quantum Machinery Group has a full inventory of Plate Rolls, Cold Saws, Band Saws, Press Brakes, Shears, Angle Rolls, Lasers, Welding Tables, Roll Benders, Ornamental Working Machinery and other equipment ready for immediate delivery.

Ready to move on your next machinery purchase? Call one of our machinery specialists today for a quote. *Flexable Financing Available!* (909) 476-8007 / Sales@QuantumMachinery.com